| Friday, 26 April 2024 | ||||||||||||||||||||||||

|

₹71,510▲ Change: Up by +36 (0.05%) Gold price today in India is given in ₹/10 g. |

||||||||||||||||||||||||

|

71,255

71,510

| ||||||||||||||||||||||||

|

Today

High: ₹71,510

Low: ₹71,255

Average Price: ₹71,246

Prv Close: ₹71,474

Last 12 hours

|

||||||||||||||||||||||||

| Gold Market Volatility LOW ▼ | ||||||||||||||||||||||||

|

||||||||||||||||||||||||

| Today gold price in India for 24 karat gold is 71,510 rupees per 10 grams. Gold price in India for 22 karat gold is 65,551 rupees per 10 grams. Gold rate per tola (24 karat) is ₹83,407.86 - One tola is equal to 180 troy grains which is 11.6638038 grams. | ||||||||||||||||||||||||

| Lowest Gold Price Today: ₹71,255/10 g | ||||||||||||||||||||||||

| Highest Gold Price Today: ₹71,510/10 g | ||||||||||||||||||||||||

| Gold Price Yesterday: ₹71,474/10 g | ||||||||||||||||||||||||

|

Gold Price in March 2024 Gold Price in February 2024 |

||||||||||||||||||||||||

|

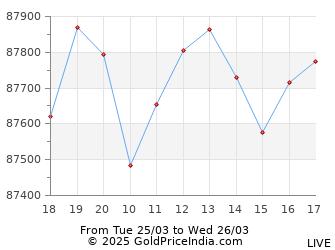

| India Gold Chart showing prices over the last 12 hours excluding weekends. |

| ₹7,151 - gold price per gram |

| ₹14,302 - gold price per 2 grams |

| ₹35,755 - gold price per 5 grams |

| ₹57,208 - gold price per 8 grams |

| ₹71,510 - gold price per 10 grams |

| ₹7,15,100 - gold price per 100 grams |

Today 24 karat gold price in India given in rupees per gram, 2 grams, 5 grams, 8 grams, 10 grams and 100 grams.

| ₹6,555 - gold price per gram |

| ₹13,110 - gold price per 2 grams |

| ₹32,775 - gold price per 5 grams |

| ₹52,441 - gold price per 8 grams |

| ₹65,551 - gold price per 10 grams |

| ₹6,55,508 - gold price per 100 grams |

Today 22 karat gold price in India given in rupees per gram, 2 grams, 5 grams, 8 grams, 10 grams and 100 grams.

|

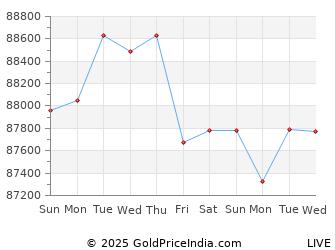

| India Gold Chart showing prices over the last 10 days |

| Period | 24 Karat | 22 Karat | Change |

|---|---|---|---|

| Today Gold Price | ₹71,510▲ | ₹65,551▲ | +36 (0.05%) |

| Thu, 25 Apr 2024 | ₹71,474▲ | ₹65,518▲ | +330 (0.46%) |

| Wed, 24 Apr 2024 | ₹71,144▲ | ₹65,215▲ | +267 (0.38%) |

| Tue, 23 Apr 2024 | ₹70,877▼ | ₹64,971▼ | -620 (-0.87%) |

| Mon, 22 Apr 2024 | ₹71,497▼ | ₹65,539▼ | -1303 (-1.82%) |

| Sun, 21 Apr 2024 | ₹72,800▼ | ₹66,733▼ | +0 (0%) |

| Sat, 20 Apr 2024 | ₹72,800▲ | ₹66,733▲ | +181 (0.25%) |

| Fri, 19 Apr 2024 | ₹72,619▲ | ₹66,567▲ | +76 (0.1%) |

| Thu, 18 Apr 2024 | ₹72,543▼ | ₹66,498▼ | -693 (-0.96%) |

| Wed, 17 Apr 2024 | ₹73,236▲ | ₹67,133▲ | +401 (0.55%) |

| Tue, 16 Apr 2024 | ₹72,835▼ | ₹66,765▼ | +0 (0%) |

Last 10 days gold price in India for 24 karat and 22 karat gold given in rupees per 10 grams. Note: MCX provides 24 karat (999.9 purity) gold price only. The above presented 22 karat (91.6 purity) gold price is derived from 24 karat MCX gold price applying a standard karat calculation formula used in the market.

| City | 24 Karat | 22 Karat |

|---|---|---|

| Chennai | ₹70,678 | ₹67,308 |

| Mumbai | ₹70,758 | ₹67,388 |

| Bangalore | ₹71,098 | ₹67,708 |

| Delhi | ₹70,988 | ₹67,608 |

| Kerala | ₹0 | ₹0 |

| Kerala | ₹69,938 | ₹66,608 |

| Hyderabad | ₹70,678 | ₹67,308 |

| Kolkata | ₹71,618 | ₹68,208 |

| Pune | ₹70,758 | ₹67,388 |

| Gold Price in India (*MCX) | ₹71,510 | ₹65,551 |

Today gold price in India for 24 karat and 22 karat gold in major cities across the country, given in rupees per 10 grams. The Gold price in India varies across many cities due to various local market factors for example, demand and supply of gold, state government taxes and transportation charges of physical gold.

24 karat gold is also known as 999 gold and is the purest form of gold available in market in the form of gold coins and bars. Similarly, 22 karat gold is known as 916 gold and is generally used to make jewellery.

*MCX: Multi Commodity Exchange of India Ltd. Today gold price in India cities was last updated on Friday, 26 April 2024

|

| India Gold Chart showing prices over the last 10 days |

| Type | Period | ₹/10 g |

|---|---|---|

| Lowest Gold Price | 01 Apr 2024 | ₹67,801 |

| Highest Gold Price | 12 Apr 2024 | ₹73,557 |

| Gold Price | 01 Apr 2024 | ₹68,326 |

|

The highest gold price in India in the month of April 2024 was 73,557 rupees per 10 grams while the lowest gold price was 67,801 rupees. Gold price on 01 Apr 2024 was 68,326 rupees per 10 grams. |

||

| Type | Period | ₹/10 g |

|---|---|---|

| Lowest Gold Price | 01 Mar 2024 | ₹61,939 |

| Highest Gold Price | 29 Mar 2024 | ₹67,804 |

| Gold Price | 01 Mar 2024 | ₹62,595 |

| Gold Price | 31 Mar 2024 | ₹67,800 |

|

The highest gold price in India in the month of March 2024 was 67,804 rupees per 10 grams while the lowest gold price was 61,939 rupees. Gold price on 01 Mar 2024 was 62,595 rupees per 10 grams. Gold price at the end of month was 67,800 rupees. |

||

| Type | Period | ₹/10 g |

|---|---|---|

| Lowest Gold Price | 14 Feb 2024 | ₹61,308 |

| Highest Gold Price | 05 Feb 2024 | ₹63,704 |

| Gold Price | 01 Feb 2024 | ₹63,002 |

| Gold Price | 29 Feb 2024 | ₹61,942 |

|

The highest gold price in India in the month of February 2024 was 63,704 rupees per 10 grams while the lowest gold price was 61,308 rupees. Gold price on 01 Feb 2024 was 63,002 rupees per 10 grams. Gold price at the end of month was 61,942 rupees. |

||

| Type | Period | ₹/10 g |

|---|---|---|

| Lowest Gold Price | 18 Jan 2024 | ₹61,476 |

| Highest Gold Price | 02 Jan 2024 | ₹63,632 |

| Gold Price | 01 Jan 2024 | ₹63,325 |

| Gold Price | 31 Jan 2024 | ₹63,040 |

| Type | Period | ₹/10 g |

|---|---|---|

| Lowest Gold Price | 29 Dec 2023 | ₹63,114 |

| Highest Gold Price | 28 Dec 2023 | ₹63,800 |

| Gold Price | 01 Dec 2023 | ₹62,509 |

| Gold Price | 31 Dec 2023 | ₹63,217 |

For more gold news in India, visit: in.investing.com

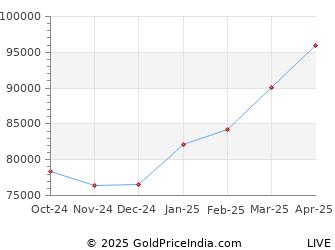

| Date | Price (INR) | Change |

|---|---|---|

| 26 April 2023 | ₹60,305 | +8598 ▲ |

| 26 April 2022 | ₹51,707 | +4231 ▲ |

| 26 April 2021 | ₹47,476 | +877 ▲ |

| 26 April 2020 | ₹46,599 | +14629 ▲ |

| 26 April 2019 | ₹31,970 | +722 ▲ |

| 26 April 2018 | ₹31,248 | +2522 ▲ |

| 26 April 2017 | ₹28,726 | -464 ▼ |

| 26 April 2016 | ₹29,190 | +2470 ▲ |

| 26 April 2015 | ₹26,720 | -2178 ▼ |

| 26 April 2014 | ₹28,898 | +1898 ▲ |

| 26 April 2013 | ₹27,000 | -2018 ▼ |

| 26 April 2012 | ₹29,018 | +7107 ▲ |

| 26 April 2011 | ₹21,911 | +5106 ▲ |

| 26 April 2010 | ₹16,805 | +2181 ▲ |

| 26 April 2009 | ₹14,624 | - |

Historical data of today gold price in India for 24 karat gold given in rupees per 10 grams. To know more click here

|

| Gold History Chart showing prices over the last 10 years |

GoldPriceIndia.com has the latest gold prices in India and other local cities such as Mumbai, Delhi, Chennai, Bangalore, Hyderabad and more such cities. We also have prices of Gold in other countries such as Dubai and other middle east countries like Saudi Arabia, Qatar, Oman, Kuwait, Bahrain and many more. We also provide gold ETF NAV price, Silver price in India, Platinum price in India as well as historical data in India and other related information to help your investment in gold.

|

₹55,247

2,450AED |

| ₹/10 g (INR) |

|

Today gold price in Dubai for 24 karat gold given in rupees per 10 grams. To know more click here |

© 2024. All rights reserved GoldPriceIndia.com